Federal Reserve trails global counterparts in balance sheet reductions, data reveals

Quick Take

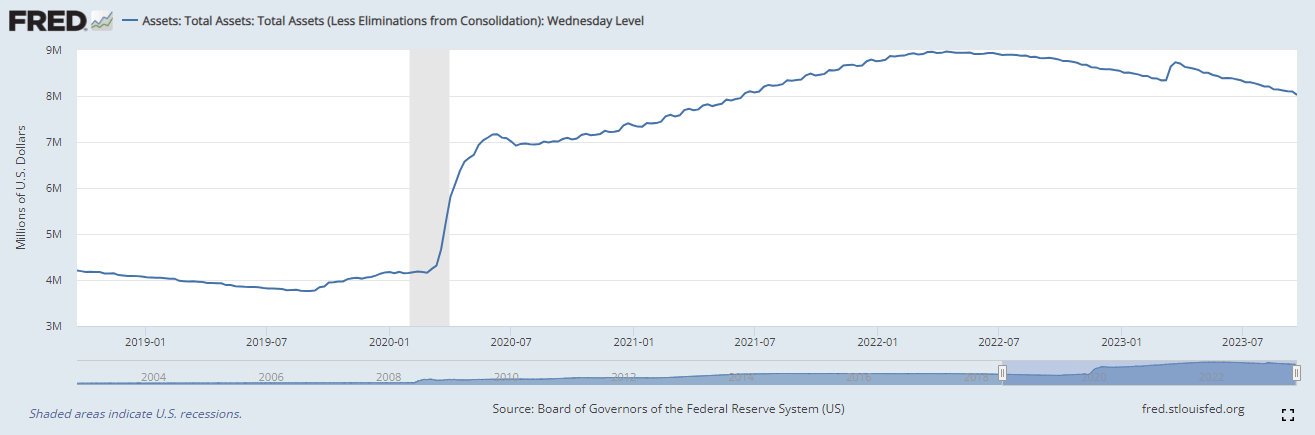

The Federal Reserve’s balance sheet of total assets has seen a reduction of an additional $75 billion in the past week, with total assets now slightly surpassing the 8 trillion mark. For context, prior to the COVID-19 pandemic, the Fed’s balance sheet was approximately $3.5 trillion.

Despite the considerable distance yet to be covered, substantial efforts have been made to reduce the balance sheet via quantitative tightening, achieving a reduction of about 5.5% year to date.

It is interesting, however, to juxtapose this with other leading global central banks. The Bank of England (BOE) has surpassed the Fed’s reduction rate with a 6.5% decrease, the People’s Bank of China (PBoC) at 7.5%, and both the Bank of Japan (BOJ) and the European Central Bank (ECB) have outpaced with reductions exceeding 10%.

This continuation of quantitative tightening will put further pressure on bond yields, with the U.S. 10-year treasury yield rising to 4.5%.

This data underscores the concerted global effort by central banks to rebalance their respective financial territories, navigating the delicate path of recovery in the post-pandemic world.

The post Federal Reserve trails global counterparts in balance sheet reductions, data reveals appeared first on CryptoSlate.

source https://cryptoslate.com/insights/federal-reserve-trails-global-counterparts-in-balance-sheet-reductions-data-reveals/

Post a Comment for "Federal Reserve trails global counterparts in balance sheet reductions, data reveals"