Bitcoin’s recent decline mirrors past cycle trends

Quick Take

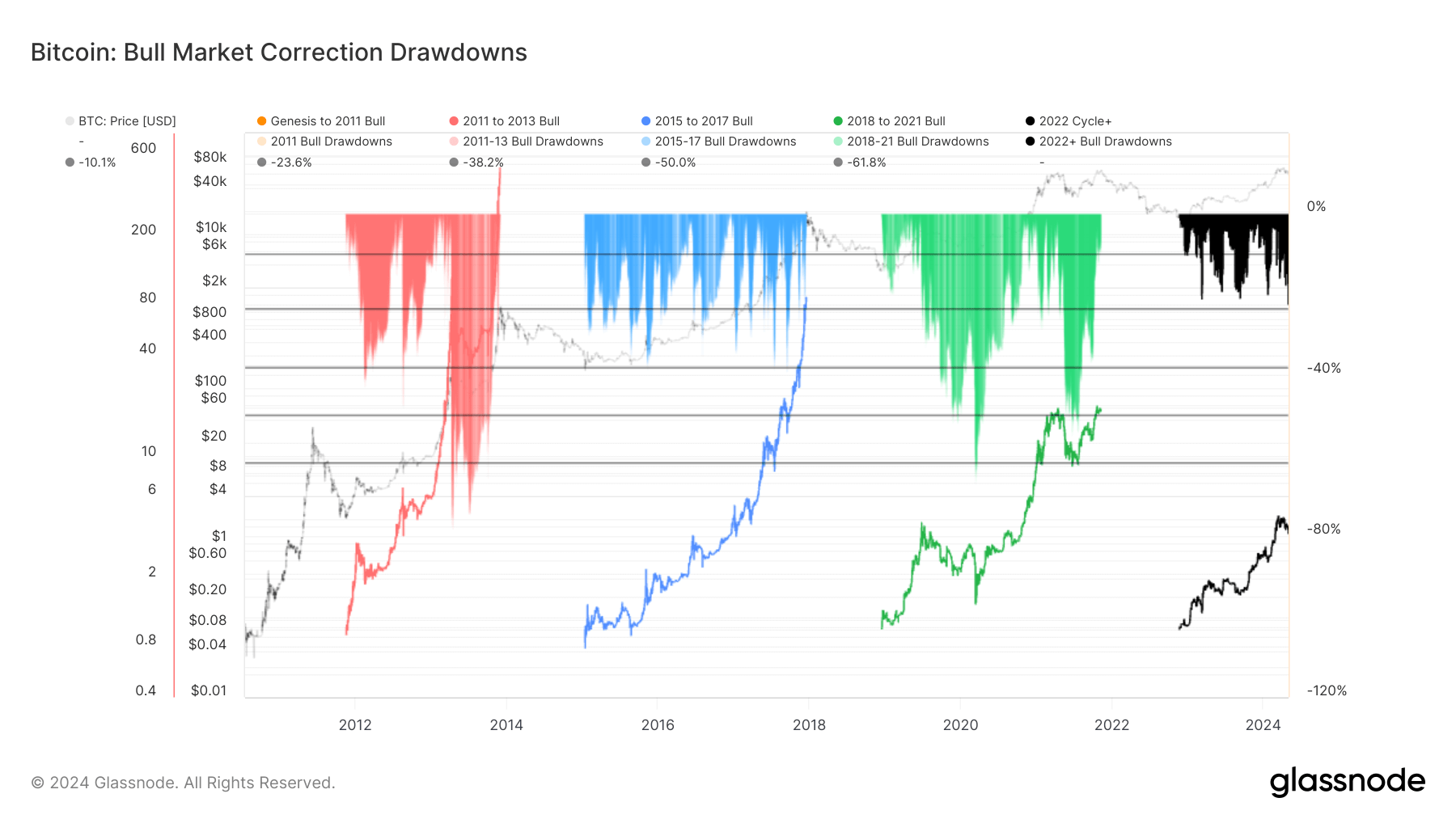

Bitcoin has undergone a correction of approximately 23% from its peak of $73,600 in March. Analyzing historical cycles can offer valuable perspectives on its current price dynamics.

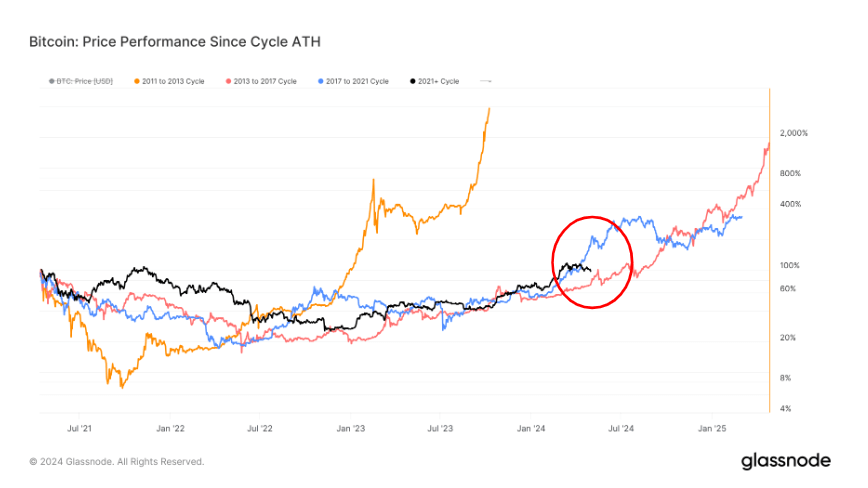

Glassnode data indicates that Bitcoin is presently down by 12% from its 2021 peak, established in April 2021. This positions it between the trajectories of the two preceding cycles at this stage.

In the 2013-2017 cycle, Bitcoin was around 30% below its all-time high at this point. Meanwhile, in the 2017-2021 cycle, it was over 50% above its peak. The current drawdown sits in the middle ground between these prior cycles.

However, both previous cycles experienced significant drawdowns from their highs at this stage. In the 2013-2017 cycle, there was a 30% decline, while the 2017-2021 cycle saw an even larger pullback.

Given this historical pattern, a 30% drawdown from the $73,600 peak to around $51,000 appears plausible for Bitcoin in the current cycle. While past performance doesn’t guarantee future results, the recent correction aligns with Bitcoin’s typical cyclical behavior.

The post Bitcoin’s recent decline mirrors past cycle trends appeared first on CryptoSlate.

source https://cryptoslate.com/insights/bitcoins-recent-decline-mirrors-past-cycle-trends/

Post a Comment for "Bitcoin’s recent decline mirrors past cycle trends"