Bitcoin’s 2024 market patterns echo 2019

Quick Take

According to a recent analysis by CryptoSlate, the current Bitcoin market is behaving in a strikingly similar pattern to that of 2019.

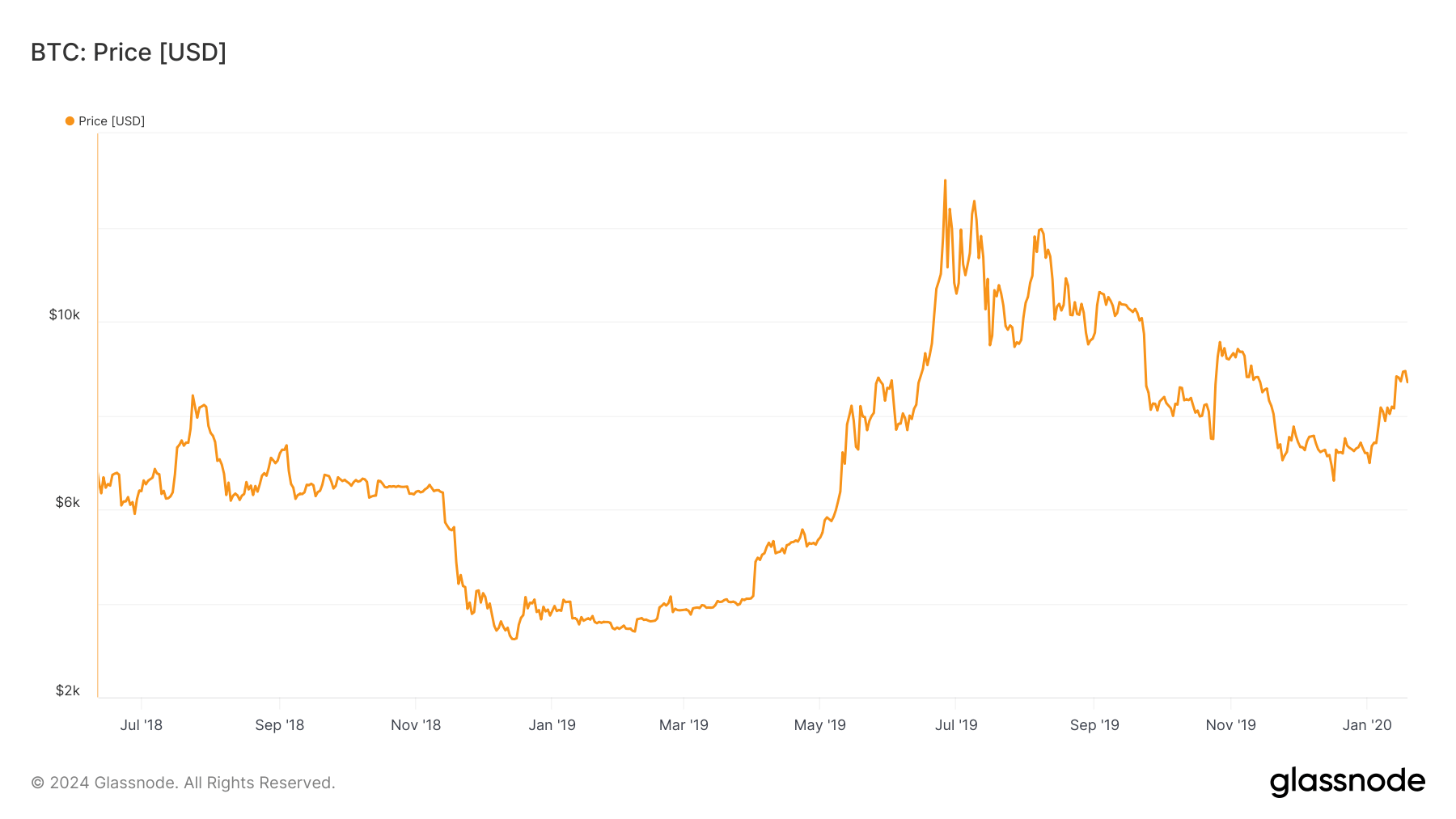

Since reaching an all-time high of approximately $73,000 in March, Bitcoin has been fluctuating mostly within the $60,000 range, reminiscent of previous periods of market consolidation. Notably, Bitcoin lingered in the $9,000 range longer than it has at $58,000, but the current trading pattern suggests a potential repeat of history.

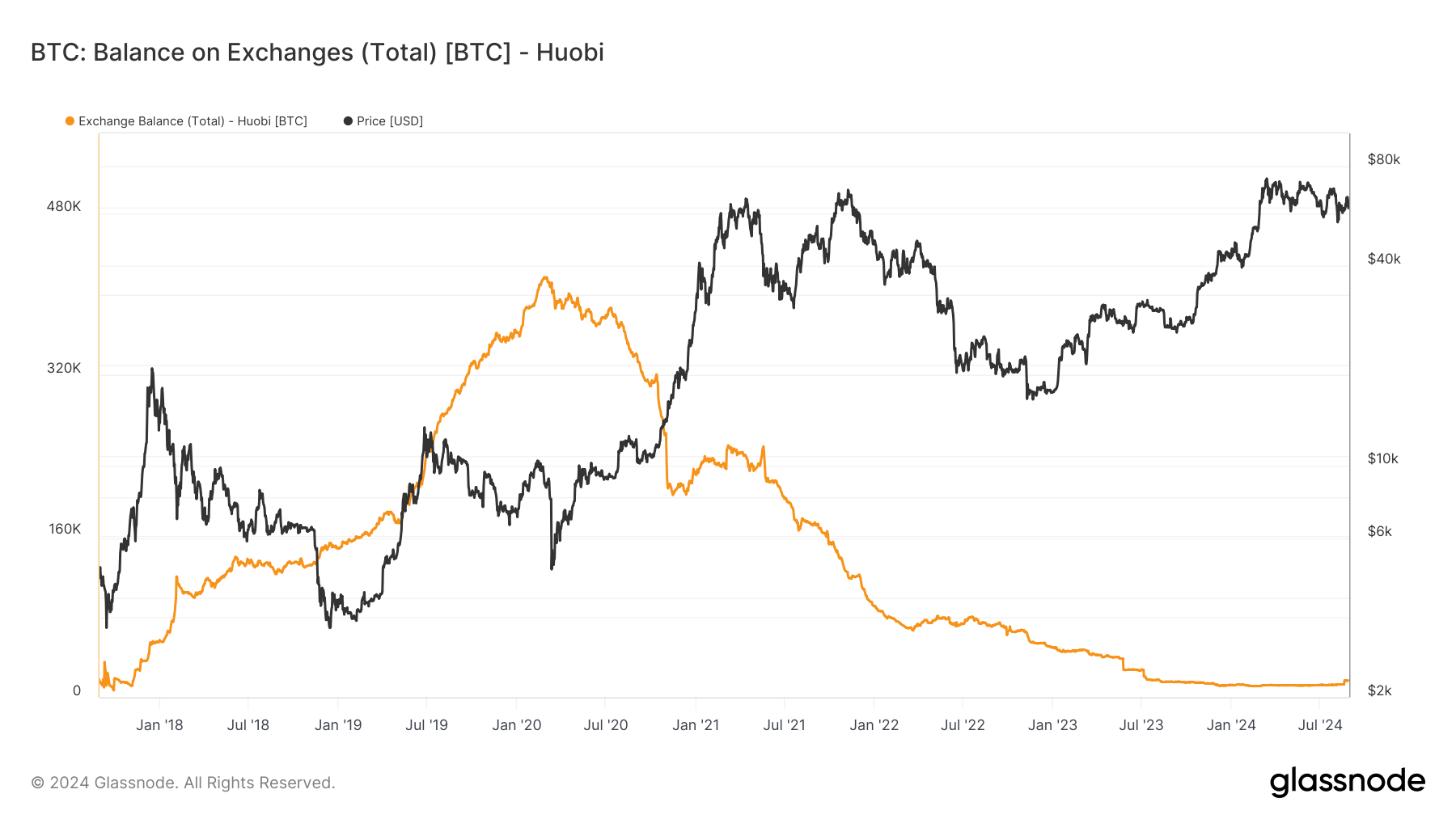

Analyst Checkmate recently highlights further parallels with the market in 2019. In April of that year, Bitcoin’s price was around $4,000 before surging to $14,000 by July, driven by the Ponzi scheme PlusToken in China, which absorbed about 2% of the Bitcoin supply. However, after the Chinese government sold the assets on Huobi, the price plunged back to $9,000 until the COVID-19 crash.

Meanwhile, in 2024, the launch of US Bitcoin ETFs initially drove the price from $50,000 to $73,000, echoing the surge to $14,000 in 2019. Subsequent sales by the US and German governments, alongside distributions from Mt. Gox, led to a volatile market that has seen a consolidation period.

The latest significant event, the Aug. 5 yen carry trade unwind, pushed Bitcoin down to $49,000, with the price now stabilizing again in the $60,000 range. These patterns suggest that Bitcoin’s market behavior in 2024 continues to mirror the movements in 2019.

The post Bitcoin’s 2024 market patterns echo 2019 appeared first on CryptoSlate.

source https://cryptoslate.com/insights/bitcoins-2024-market-patterns-echo-2019/

Post a Comment for "Bitcoin’s 2024 market patterns echo 2019"